Customs clearance: digital and smooth

No hassle with complicated forms or unexpected delays. Our customs specialists arrange it all digitally and well in advance - even before your shipment arrives. Any questions? We're always there for you. Via rotraNext you can see exactly how your shipments are doing. So you can focus on what you are good at, while we make sure everything goes smoothly through customs.

Your customs specialist experienced in complex customs matters

In house customs department

Our specialists sit next to our forwarders. That's easy to talk to, and it allows us to be on the ball quickly.

AEO certification

Rotra is AEO certified with which shipments subject to customs regulations have fast and efficient handling at Rotra.

Direct and limited fiscal representation

With our own customs department, we can quickly and digitally interface with customs authorities, NVWA and PD for the handling of all customs formalities.

Chamber of Commerce and embassy certification

Eur.1, ATR, legalization of invoices, documents of origin. With our KVK and embassy certifications, we can relieve you of all your worries.

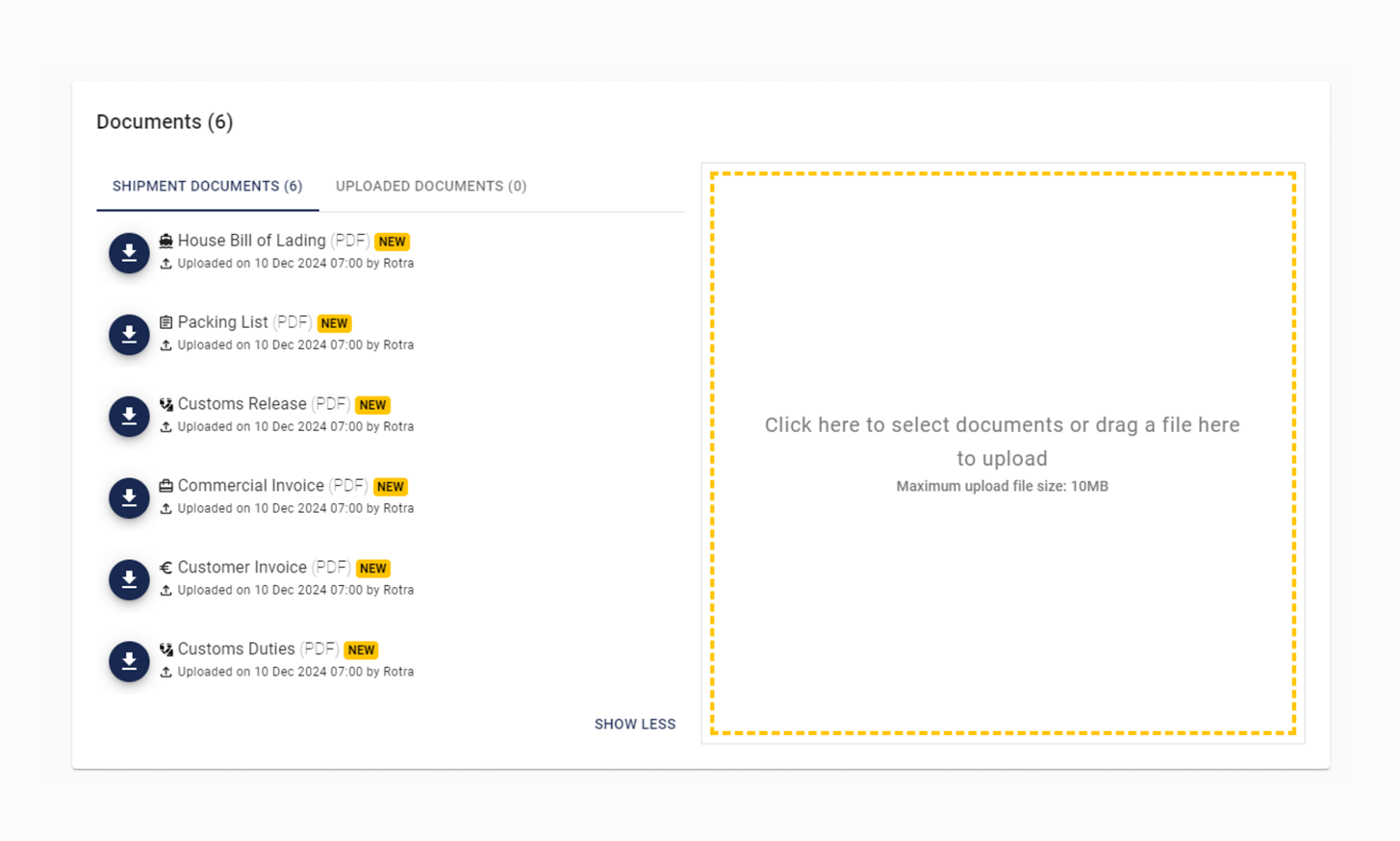

Customs clearance is also easier digitally

Upload all your paperwork into our portal, communicate directly with the duoane administrator and get notifications if your shipment gets stuck behind customs. These are the advantages of digital customs declaration:

Proactive notifications

Receive automatic notification when containers are at risk of detention or demurrage charges become applicable. This prevents unnecessary costs and frustration.

CBAM data insightful

The new CBAM regulations are easier with an overview of CBAM mandatory shipments. Our customs department will gladly provide you with an overview.

Personal contact

No more endless email conversations, just one overview with all documents and direct communication in rotraNext with the employee doing your handling. Handy!

Intrastat declaration

As your representative, we can take care of Intrastat declarations to CBS for your European goods trade.

AGS & DMS

Easily control import, export and transit digitally. This is possible from different locations.

Ship today digitally. Start with a 15-minute demo

Every day, more than 2,000 companies worldwide rely on rotraNext.

Our services at a glance

Want to learn more?

You don't have your most complex shipments every day. That's why our specialist is here to help you with the necessary documents. We have listed common questions in advance, which makes a difference. Check them out below to go directly to our full customs knowledge base.

Each Incoterm specifies the exact division of responsibilities between the seller and the buyer of the goods. But what exactly is the difference between DAP and DDP? And how does FCA differ from EXW? Read all about the Incoterms in our knowledge base.

Checking and looking up an EORI number can be done in the EU EORI database. In doing so, Customs uses the EORI number to determine whether and which AEO status the operator in question has.

The Taric code and the CN code are codes that universally categorize goods and are needed for importing and exporting goods. The Taric code is the code needed for importing goods from outside the EU, the CN code is used for exporting outside the EU.

The EUR.1 certificate is a customs document that allows you to obtain a reduction or exemption from import duty in the destination country if you can prove that the products were produced in EU.

The European Union has concluded trade agreements with a number of countries to promote trade between participating countries or groups of countries. These trade agreements allow the importer to use preferential duty. That is, the importer gets reduction or exemption from import duties. The condition is that the goods must be of preferential origin (that is, originating from a favored country). You can prove this by means of a EUR.1 certificate. In the Netherlands, a Eur1 document is issued by the Chamber of Commerce.

The Intrastat code is an 8-digit code used to categorize goods. Intrastat codes are used within the Intrastat system. This system is used within the European Union for the exchange of information on import and export of goods. Intrastat codes are also called commodity codes or HS codes. Their use, function and the codes themselves are the same (per country). The list of codes is updated annually based on adjustments needed for Customs as well as for statistics. CBS has a list of current codes available on its website.

With direct representation, the customs broker makes a customs declaration in the name of the represented party and on behalf of the represented party. The represented party is also held liable for the declaration. Direct representation is possible for both import and export in the Netherlands.

Ship digital in 15 minutes! Start with a personal demo.

Discover our digital logistics platform in just 15 minutes! Our specialists will show you how our software transforms your supply chain. Try it for free and transform your logistics workflow with one click.

.jpg)